AKA

Urban high-rise properties in some of the most exclusive neighborhoods in the world, operated as 100% furnished residences and/or boutique hotel properties. These buildings offer the quality and spaciousness of the finest condominiums, with the amenities and services of a luxury hotel.

Target Properties

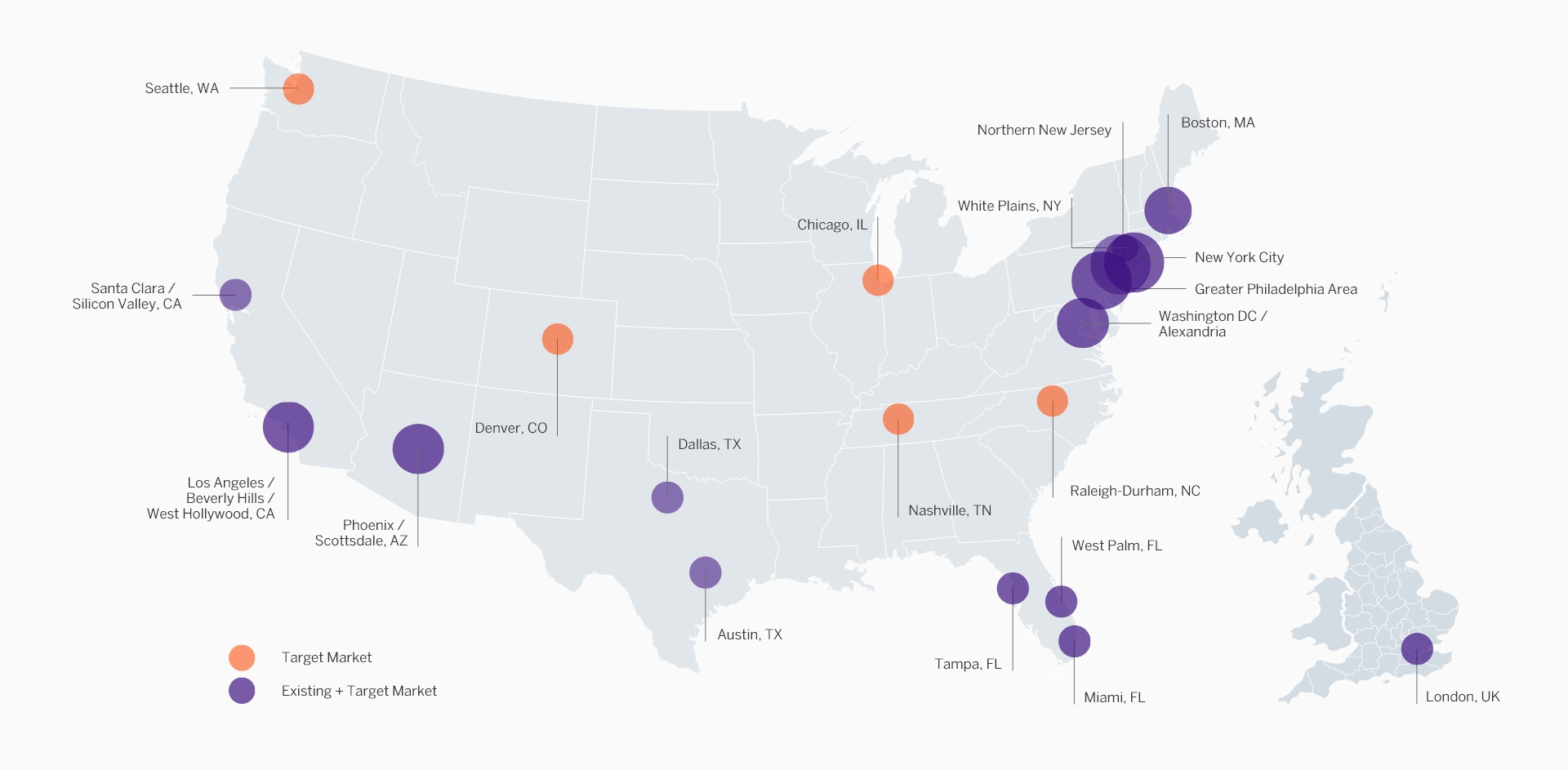

100–250 Key Hotel or Residential buildings located in prestigious metropolitans offering a mix of leisure and corporate demand with opportunity to enhance value through improved management, rebranding and renovation.

Platform Objectives

AKA drives ADR through a superior offering and guest experience. The AKA operating model optimizes expense efficiencies by extending length of stay and minimizing OTA usage through direct sales to achieve a higher EBITDA margin. This differentiated strategy allows investors to maximize value through flexible exit options.

_Tablet.webp?language=en)